IRS Penalty Abatement Help in Orange County

Remove or Reduce IRS Penalties Legally — With Help from a Local CPA

If you've been hit with massive IRS penalties on top of your back taxes, you're not alone. Many Orange County taxpayers discover their IRS balance has doubled due to penalties for late filing, late payment, or failure to deposit payroll taxes. At Boulanger CPA and Consulting PC, we help individuals and business owners reduce or eliminate these penalties through the IRS Penalty Abatement.

What Is IRS Penalty Abatement?

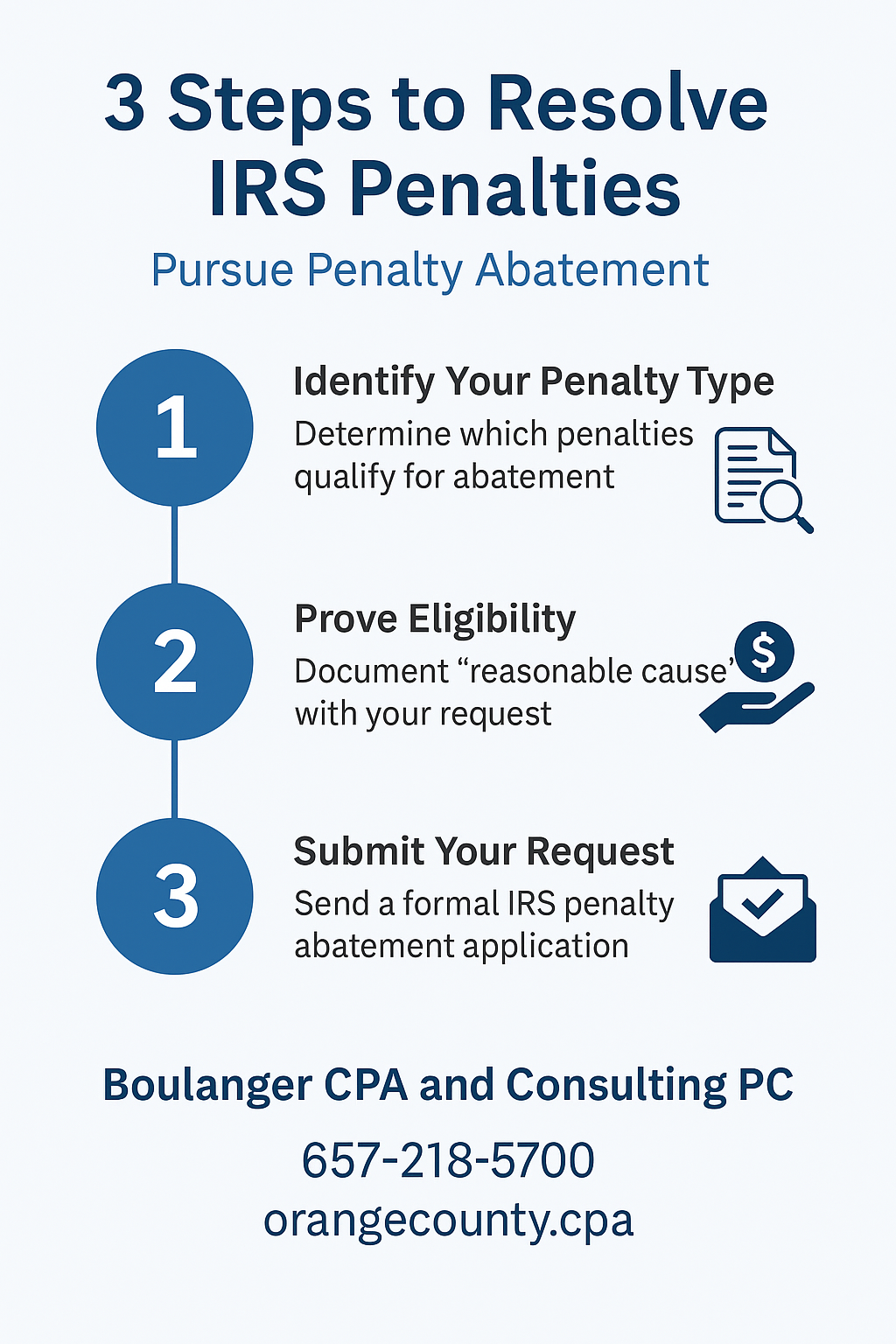

Penalty abatement is a formal IRS process that allows taxpayers to request removal or reduction of penalties if certain qualifications are met. There are three primary types:

- First-Time Abatement (FTA)

- Reasonable Cause Abatement

- Statutory Exception or Administrative Waiver

Each type requires a different strategy and documentation, and the IRS won't volunteer these options unless you ask for them.

Common IRS Penalties That Can Be Abated

- Failure to File (Form 1040, 1120, etc.)

- Failure to Pay (underpayment or missed deadlines)

- Failure to Deposit (payroll taxes, Form 941)

- Estimated Tax Penalties (individuals and businesses)

These penalties can total 25% to 50% of your total IRS balance — and they continue to grow with interest if not addressed. If penalties are inflating your IRS balance, there are options available such as an

Offer In Compromise or

Installment Agreements.

Do You Qualify for IRS Penalty Relief?

You may be eligible for abatement if:

- You’ve filed all required returns (or will file with us)

- You have a clean IRS compliance history (for FTA)

- You experienced hardship, illness, or natural disaster (Reasonable Cause)

- You received incorrect IRS advice (Statutory Exception)

We review your IRS transcripts, compliance records, and notices to determine which type of abatement you're most likely to win.

How We Help Orange County Taxpayers Remove IRS Penalties

- Transcript Review — We pull your IRS records to verify penalty amounts and assess compliance history.

- Qualification Analysis — We determine whether you're eligible for First-Time Abatement or Reasonable Cause relief.

- Formal Abatement Request — We prepare IRS Form 843 or penalty relief requests with full documentation, legal citations, and a CPA letter.

- Negotiation & Follow-Up — We handle all communication with the IRS and fight for full or partial removal.

Why Choose Boulanger CPA for IRS Penalty Relief?

- 14+ years of IRS representation experience

- Flat-fee pricing — no hourly surprises

- Local Orange County office with virtual availability statewide

- CPA + Certified Tax Resolution Specialist

- We've successfully removed thousands in penalties for our clients

Don’t Let Penalties Double Your IRS Debt

The IRS adds penalties automatically — but you don’t have to accept them. We help Orange County taxpayers stop the bleeding and move forward with confidence.

Schedule a confidential case review today and see if you qualify for penalty relief.

[Book Your Consultation]

[Call 657-218-5700] [Email

marc@boulangercpa.com]

FREQUENTLY ASKED QUESTIONS

How much can the IRS actually remove in penalties?

In some cases, we’ve helped clients wipe out 100% of penalties. Most see partial relief if the case is presented correctly.

Do I need to be fully paid up to qualify?

Not always. Certain relief options allow abatement even before full payment, depending on circumstances.

How long does it take to get a decision?

Typically 2–4 months, depending on the case and IRS backlog.

Can I do this myself?

Yes, but many DIY abatement requests are denied due to weak arguments or missing documentation. Having a CPA advocate makes a major difference.